Earlier this summer, the Exit Planning Institute (EPI) released the 2025 State of Owner Readiness™ Generational Report, offering a sweeping analysis of how business owners across generations are preparing —or failing to prepare—for their eventual exits.

With over 1,100 business owners surveyed, the report reveals stark generational differences in education, planning, and mindset.

For Capitaliz, a platform built to empower advisors and their clients, these insights are both a call to action and a roadmap for impact.

As we provide our thoughts below, we encourage advisors and owners to download the report from EPI and review it’s entirety to dive deeper into this invaluable data. They have also further dissected this report in other content pieces on their site, providing perspective to these findings compared to EPI surveys conducted over the last decade.

Key Findings by Generation

Baby Boomers (Ages 61–79 in 2025): The Least Prepared

- 58% plan to exit in the next 5 years, yet only 13% have a formal personal plan and 22% have completed a value enhancement project

- Many lack formal valuations, estate plans, and contingency strategies.

- Their businesses are often deeply tied to their personal leadership, which can sommetimes make the business less attractive to buyers.

- Many owners do not have the option to exit on their terms as this group is at higher risk for external factors—like divorce, disagreement, disability, distress, or death—to force a sale.

Generation X (Ages 45–60): The Middle Ground

- 87% agree exit planning is important, but only 57% have it their priority list

- They value autonomy and work-life balance, but often lack formal advisory teams and are more prone to “boomerang exits,” or multiple business transitions through their careers.

- Financial planning is more advanced than Baby Boomers, yet still underdeveloped.

- 70% of owners report having a formal exit planning education, giving them greater awareness of available exit options.

Millennials (Ages 29–44): The Most Ready, But Not Perfect

- 85% have formal exit planning education, and 84% have completed a value enhancement project

- They embrace internal transitions (ESOPs, family transfers) and plan multiple exits.

- Despite high confidence in their exit-readiness, only 68% have a written personal financial plan and 44% have a formal written business transition plan, leaving room for improvement.

Implications for Capitaliz Advisors

Having worked closely in strategic partnership with EPI for years, Capitaliz is uniquely positioned to address the gaps highlighted in the report.

As a digital platform that operationalizes the Value Acceleration Methodology™, Capitaliz can help owners and advisors move from intention to execution, through all three gates and beyond.

For more on how Capitaliz aligns with and supports the methodology, check out the recording of a recent webinar presented in partnership with EPI.

Bridging the Education Gap

Capitaliz can support Baby Boomers and Generation X by offering structured onboarding, educational modules, and advisor-led workshops. The platform’s ability to visualize the Three Legs of the Stool—personal, financial, and business readiness—makes it easier for these owners to understand and act.

Automating Value Enhancement

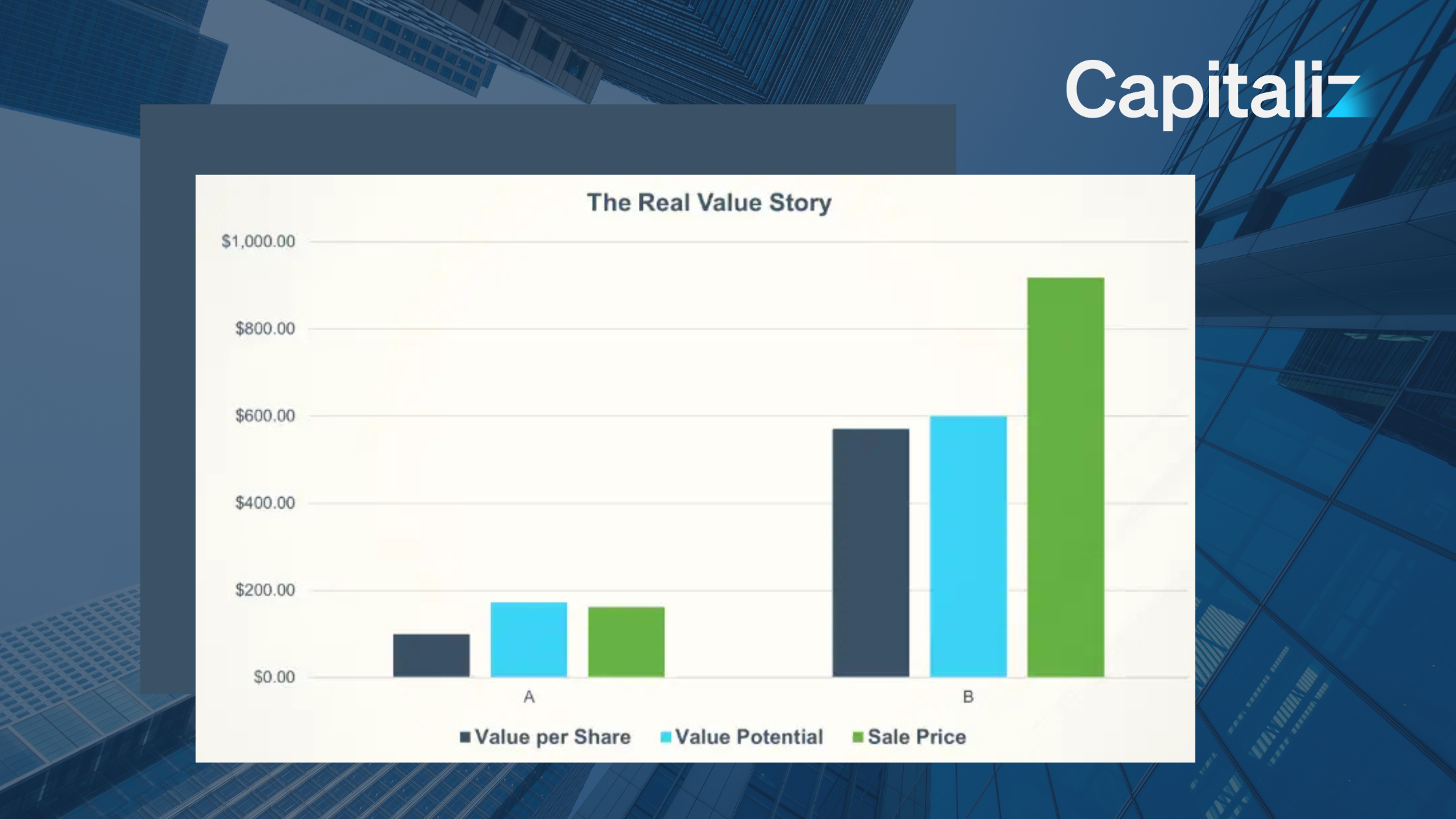

With only 22% of Baby Boomers and 62% of Gen X having completed a value enhancement project, Capitaliz can automate due diligence, risk assessments, and value growth tracking. With platform tools that illustrate value growth and value potential, owners can see tangible progress and makes their businesses more attractive to buyers.

Supporting Boomerang Exits

Millennials are often planning multiple exits over the course of their careers. Capitaliz can help them build repeatable systems for value creation, transition planning, and reinvestment strategies.

The dashboard-driven approach aligns perfectly with Millennials’ desire for speed, control, and impact.

Facilitating Advisory Collaboration

The report emphasizes the need for a four-member advisory team: financial advisor, attorney, accountant, and value growth advisor.

Capitaliz enables seamless collaboration among these professionals, centralizing documents, plans, and communications. The platform also allows for streamlined communication and delegation between the advisor team, owners, and all stakeholders.

Capitaliz Solutions for All Generations

|

Owner’s Challenge |

Capitaliz Solution |

| Lack of formal exit and succession planning | Guided workflows for personal, financial, and business planning

|

| Poor or innacurate valuation practices

|

Integrated valuation tools and advisor collaboration |

| Low awareness of exit options | Educational content and scenario modeling |

| No advisory team

|

Advisor matching and team-building features |

| Generational communication gaps | Meeting templates, resources, and engagement tools |

| Lack of planning framework | Process designed in alignment with EPI’s methodology, provide structured, data-backed guidance and actions. |

For more details on the Capitaliz advisor platform, book a demo learn more on how you can help your clients overcome the above challenges and more.

Conclusion: The $14 Trillion Opportunity

EPI’s 2025 State of Owner Readiness™ Generational Report estimates that $14 trillion in privately held business wealth will transition by 2033. The quarterly Capitaliz Value Potential Index (VPI) reports reiterate the magnitude of this upcoming wealth transfer, highlighting the importance of proactive planning.

Capitaliz can be the engine that powers this transition —helping owners build significant businesses, not just successful ones. Advisors using Capitaliz for proper preparation ensures their owner clients don’t leave money on the table, unlock their business’s full value potential, and secure a lasting legacy.

For Baby Boomers, the time is now. For Generation X, the mindet shift must begin. For Millennials, prevision and structure will be key.

With Capitaliz, advisors are ready to meet each generation where they are, and take them where they need to go.

Be sure to download EPI’s 2025 State of Owner Readiness™ Generational Report for more insightful generational analysis and what that means for advisors.

For more on the future of exit planning across generations, check out these related Capitaliz resources: