As advisors, we know that the most successful exits aren’t driven by luck — they’re built on structure, clarity, and disciplined execution. One of the most powerful levers you can pull to help your clients prepare for succession or exit is corporate governance.

Corporate governance — the framework through which a business is directed, controlled, and held accountable — is often underestimated in privately held companies. Yet, it is a core driver of value, risk management, and exit readiness. When properly implemented, governance transforms succession planning from an abstract checklist into a strategic, measurable advantage.

How Governance Drives Value and Reduces Risk

Turn Subjective Planning Into Objective Confidence

Strong governance does three things that advisors can help clients achieve:

1. Clarifies Roles and Decision Rights

Formal governance structures document responsibilities and authority — reducing ambiguity, eliminating bottlenecks, and making the business easier to operate without the founder. This, in turn, strengthens transferable value.

2. Increases Business Continuity

Transitions often fail when key decisions depend on a single person. Governance frameworks ensure strategic decisions are resilient to leadership changes — a critical factor for buyers and successors alike.

3. Mitigates Risks Visible to Buyers

Governance-related gaps — such as unclear authority, weak reporting lines, or informal decision-making — are often red flags in due diligence. Addressing these through governance increases buyer confidence and reduces negotiation pressure.

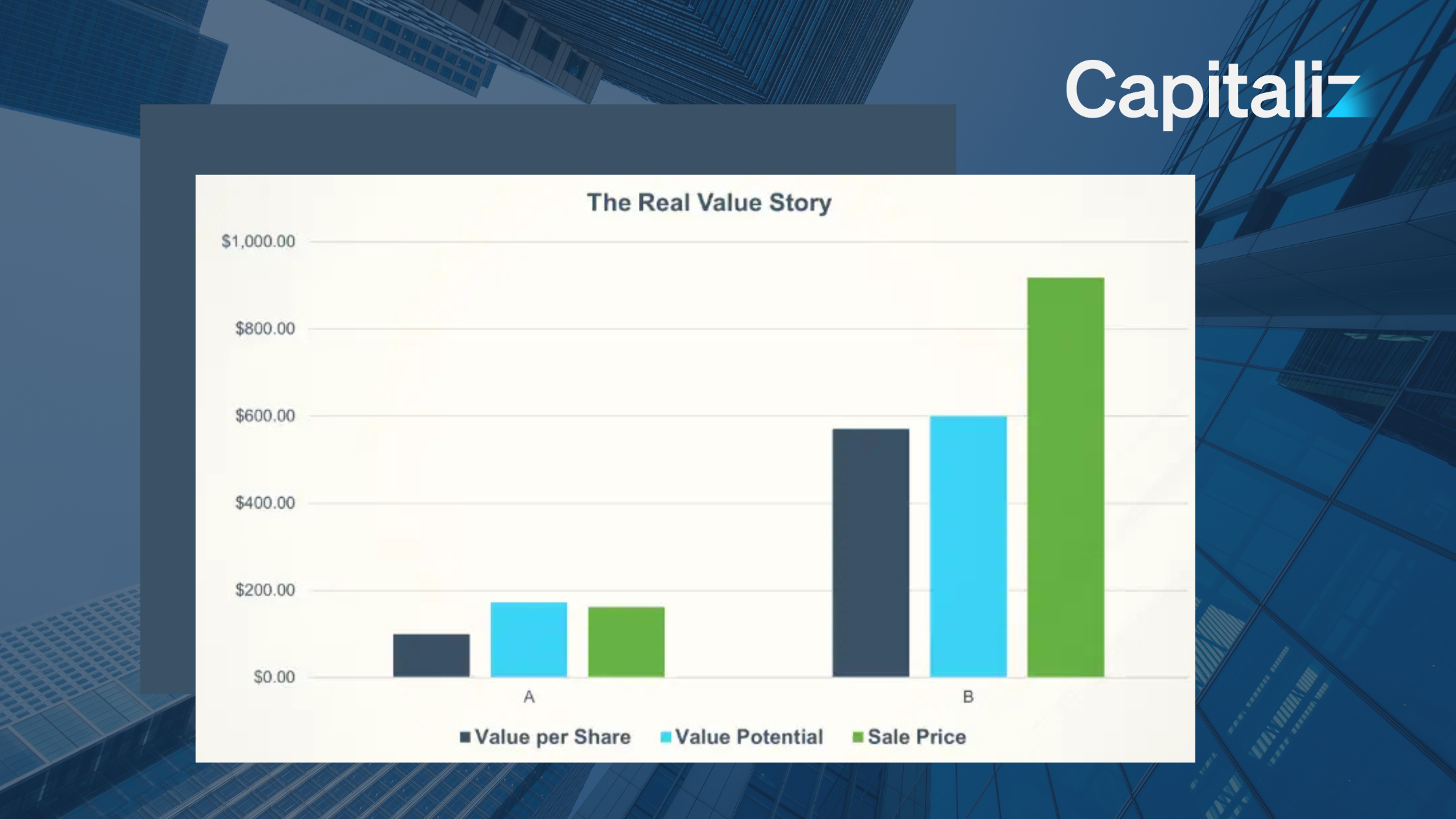

And the data supports it: businesses with documented governance practices routinely achieve higher valuation multiples than peers lacking formal structures.

Applying Governance as an Advisor

Rather than treating governance as a compliance exercise, advisors should position it as a value accelerator. Here’s how to integrate governance into your advisory approach:

1. Assess Current Governance With a Structured Audit

Start by evaluating where the client currently stands: decision-making authority, reporting lines, documentation, board/advisory structures, and policies. This sets the stage for prioritizing gap closure.

2. Introduce Advisory Boards and External Perspective

An advisory or governance board gives clients access to objective insights and fills strategic skill gaps. Advisors can help by recommending composition, charters, meeting cadences, and performance expectations.

3. Link Governance to Measurable Outcomes

Help clients define KPIs related to governance, such as:

-

Documented decision rights

-

Frequency and quality of governance meetings

-

Progress against strategic priorities

Tracking these metrics improves accountability and gives clients confidence that progress is real, not theoretical.

4. Incorporate Governance into Value Acceleration Plans

Corporate governance shouldn’t be siloed. Connect it to broader business value initiatives you’re advising on — from leadership development to operational improvements — so it feeds directly into the owner’s value creation plan.

Leveraging Capitaliz to Advance Governance

The Capitaliz platform enables you to operationalize governance improvements in the same workflow where you track value and deliver insights:

-

Use Business Insights Reports to benchmark governance indicators and highlight risk areas compared to industry standards.

-

Build governance-related actions into implementation plans so that progress shows up in projected value estimates.

-

Reevaluate regularly to show clients how closing governance gaps raises defensible value.

This makes governance a measurable initiative rather than a set of abstract recommendations — which, in turn, leads to more productive advisory conversations and clearer outcomes.

What This Means for Your Clients

Advisors who help their clients embed strong governance frameworks set them up to:

✅ Command better valuations

✅ Reduce due diligence friction

✅ Minimize key-person risk

✅ Support smoother leadership transitions

✅ Create a business buyers want to buy

In other words, governance isn’t just about good behavior, it’s about unlocking value and readiness long before a succession event or sale.

Start With the Right Framework

If your current processes don’t yet integrate governance as a strategic value lever, now is the time to change that. Using consistent tools and structured workflows — like those in Capitaliz — helps you:

-

Translate governance gaps into quantifiable risk drivers

-

Prioritize governance improvements alongside financial and operational initiatives

-

Demonstrate value impact in client planning sessions

Governance isn’t a box to tick. It’s a strategic advantage you can help clients capture.