Business owners are busy.

Their attention is pulled toward clients, staff, operations, and the never-ending demands of day-to-day management. With so much focus on the present, long-term planning—especially anything related to exit or succession—often gets postponed.

But advisors know something many owners don’t:

Succession isn’t an end-of-journey event. Done well, it’s a strategic framework that strengthens the business today.

At Capitaliz, we’ve worked with thousands of owners and advisors across industries. The most successful transitions—the ones that protect value, reduce risk, and give owners true freedom—don’t start at the finish line. They start early, intentionally, and with advisors who can guide the process.

This refreshed perspective is designed to help advisors reshape how owners think about succession planning, and how tools like Capitaliz support a more strategic, measurable, and actionable approach.

The Real Purpose of Succession Planning

Many owners equate succession with selecting a successor or prepping for sale. Advisors can help broaden that view.

Effective succession planning means building a business that can perform without the founder at the center of every decision. The goal is transferable value—value that lives in systems, people, and processes rather than the founder’s expertise.

When advisors help clients commit to true succession planning, it leads to:

- Higher business value

- Lower owner and business risk

- Stronger leadership capability

- Better client continuity

- A clearer path to personal goals

- More control over timing and terms of exit

For advisors, reframing succession this way turns it into a proactive growth strategy, not just a retirement exercise.

Why Owners Delay (and How Advisors Can Help)

Owners often delay succession planning for emotional reasons, not logical ones. Advisors hear these fears regularly:

- “What will I do after I exit?”

- “Will the next owner protect what I’ve built?”

- “What if the business can’t survive without me?”

Advisors play a crucial role in addressing these concerns, bringing objectivity and structure to a process owners often avoid.

Early planning gives everyone more room, from owners and their staff to the successors, to strengthen the business and prepare for change without pressure.

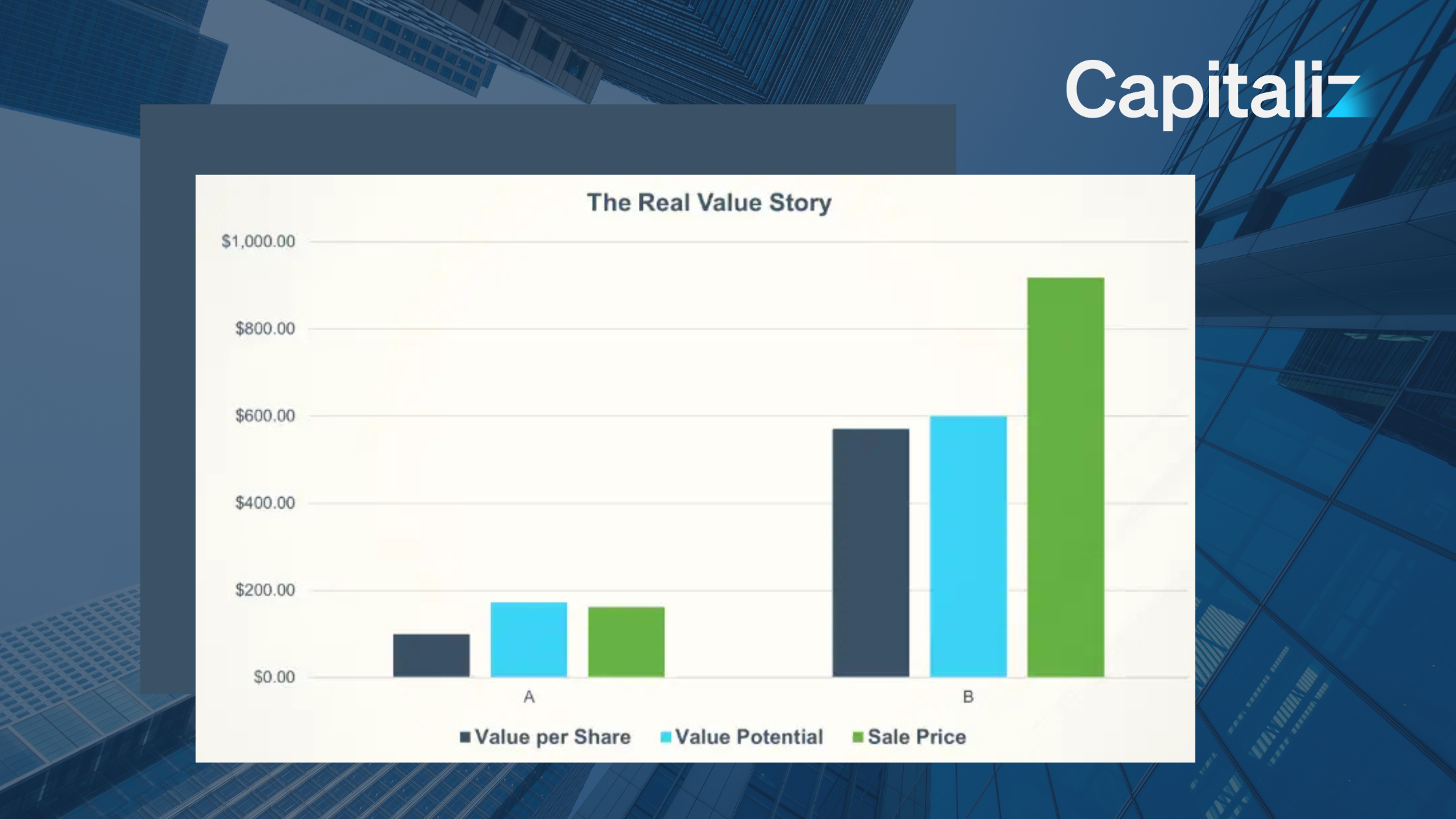

The Value Gap: Your Most Powerful Advisory Insight

One of the most effective ways advisors can engage owners is by identifying the Value Gap—the difference between current business value and potential value.

Why It Matters

The value gap highlights opportunity, not shortcomings. It reframes succession planning as a strategic improvement exercise rather than a pre-sale chore.

Advisors can help owners uncover issues like:

- Heavy reliance on the founder

- Inconsistent financial reporting

- Weak governance or unclear decision-making

- Underdeveloped or unempowered leadership teams

- Operational inefficiencies

The Capitaliz Business Insights Report quantifies these issues and reveals exactly where value is trapped—and how to unlock it. For advisors, this turns a complex conversation into a measurable, data-driven plan.

Founder Dependency: The Silent Value Killer

Advisors are often the first to see founder dependency in action. Owners act as the primary salesperson, the decision bottleneck, the problem-solver-in-chief.

This may feel productive, but it erodes transferability and suppresses value.

Advisors can guide owners to:

- Document key processes

- Delegate decision-making authority

- Develop and promote leaders

- Shift from operator to strategist

These changes take time (another reason early planning matters), but they dramatically increase both value and exit options.

Talent Without a Future Is a Flight Risk

Owners often underestimate how succession planning affects employee confidence and retention. Advisors can help them see that succession is also about:

- Identifying and developing future leaders

- Communicating long-term pathways

- Introducing incentives or equity structures

- Creating alignment around the company’s future

When employees understand how they fit into the business long-term, performance improves—and so does transferable value.

Governance: The Missing Ingredient in Most Private Businesses

Many private companies operate with informal decision-making. Advisors can elevate the conversation by showing owners how governance supports succession.

Introducing elements like advisory boards, defined decision rights, or clear partner agreements improves:

- Strategic planning

- Risk management

- Accountability

- Internal communication

And it significantly reduces conflicts during a transition.

Unplanned Exits: The Risk No One Wants to Face

Advisors know the statistics—nearly half of all business exits are unplanned. Illness, disputes, and other unexpected events can destroy value overnight.

Advisors help clients mitigate this risk through:

- Contingency and emergency plans

- Key person insurance

- Clear legal authority for decision-making

- Client and staff communication plans

Planning for the unexpected is an essential part of protecting both the business and the owner’s personal wealth.

Aligning Business Performance With Personal Goals

The best succession plans don’t start with spreadsheets—they start with conversations.

Advisors help owners uncover:

- Personal and financial objectives

- Timeline expectations

- Lifestyle or post-exit goals

- What “enough” really looks like

Capitaliz embeds this into the process:

- Step 1: Goals & Outcomes

- Step 2: Fact Find

- Step 3: Business Insights Report

These early steps give advisors clarity and owners confidence, creating a foundation for a realistic, actionable plan.

Succession Isn’t a Transaction. It’s a Transformation.

Advisors know that selling the business is only one piece of the puzzle. True succession requires:

- Shifting leadership and decision-making

- Embedding systems that protect value

- Preparing the owner emotionally and financially

- Ensuring continuity for clients and staff

With advisor support, owners experience not just a smoother exit—but a stronger business long before they transition.

Why Year-End Is the Ideal Time to Reframe the Planning Conversation

As the year winds down and owners shift into reflection mode, advisors have a unique opportunity to reposition succession and value planning—not as a distant or intimidating task, but as a strategic foundation for the year ahead.

December is when many owners finally lift their heads from day-to-day operations. They review performance, think about goals, and start imagining what they want the next year to look like. This creates a natural opening for advisors to introduce or reintroduce conversations about:

- Long-term business and personal goals

- Leadership development and team planning

- Operational improvements that can unlock value

- Risk management and succession readiness

- The owner’s timeline, preferences, and priorities

Framing planning as a 2026 readiness initiative, rather than an end-of-business event, helps owners see succession as part of setting the business up for a strong year—not something to tackle “someday.”

It’s also the perfect moment for advisors to encourage a proactive mindset:

- “What do we want your business to look like by this time next year?”

- “Which key risks should we remove now so 2026 is a growth year?”

- “What would make the business easier to run—and ultimately easier to transition?”

Year-end conversations tend to be more strategic, more open, and more honest. By guiding owners to think beyond January and toward the long-term trajectory of the business, advisors can elevate the value of their guidance and set the tone for a more intentional, better-prepared year ahead.

Final Thoughts for Advisors: Encourage Owners to Start Early

Most owners wait too long to start succession planning. Advisors can help them take the first step long before they feel “ready.”

Start with the fundamentals:

- Align goals

- Assess current value

- Identify risk

- Quantify the opportunity

Small steps lead to meaningful momentum—and dramatically better outcomes.

As we often say at Capitaliz:

“Build a business you can leave. Then decide if you want to.”

Help Your Clients Discover Their Value Gap

If your clients haven’t measured their current value or identified their value gap, the Capitaliz Value Gap Assessment is the simplest way to start the conversation.

👉 Encourage them to complete the assessment using your personalized advisor link, and bring the results into your next strategic session.