From Emotion to Execution: Helping Owners Move From Intent to Action in Exit Planning

For advisors, exit planning conversations rarely stall because of a lack of data. More often, they stall because business owners are emotionally stuck.

That was the core theme of a recent Capitaliz webinar, Emotion to Execution: Moving Owners Toward Meaningful Action, led by Jared Johnson, President of North American Operations at Capitaliz. The session explored a truth every experienced advisor has felt firsthand: logic and numbers may justify decisions, but emotion is what drives owners to act.

Help This blog unpacks the key takeaways from the session and offers a practical framework advisors can use to move clients from intention to execution—without ignoring the emotional realities that shape every exit decision.

Why Emotion Comes Before Logic

During the webinar, Jared referenced a concept popularized by Simon Sinek: the limbic brain—the part of the brain responsible for emotions and behavior—does not control language. That’s why business owners often struggle to clearly explain why they want to sell, slow down, or make a change.

They may cite rational reasons—market conditions, valuation multiples, tax considerations—but the true motivators are often emotional:

- Burnout or frustration

- Fear of making the wrong move

- Guilt about employees or family

- Pride in what they’ve built

- Desire for clarity, freedom, or legacy

As advisors, when we skip straight to logic, we risk missing the real reason an owner is (or isn’t) ready to engage.

The Emotional–Logical Divide in Exit Planning

One of the most important distinctions from the webinar was this:

- The decision to act is emotional

- The direction of that action is logical

Owners don’t decide to pursue exit planning because a spreadsheet told them to. They decide because something feels unresolved—stress, uncertainty, exhaustion, or a growing sense that time is slipping away.

Once that emotional decision is made, logic, data, and planning tools become essential. But without first engaging the emotional driver, even the best plan will sit untouched.

Universal Goals vs. Value-Based Goals

To uncover what truly motivates a business owner, advisors need to understand two distinct types of goals:

Universal Goals

These are the questions nearly every owner must answer:

- When do I want to exit?

- How much do I need?

- Who will the business go to?

These goals create structure, but they rarely spark action on their own.

Value-Based Goals

Value-based goals tap directly into emotion and identity, such as:

- Protecting employees

- Preserving a legacy

- Supporting a community

- Funding philanthropy or family opportunities

When advisors help owners connect universal goals to value-based goals, exit planning stops feeling like an abstract exercise and starts feeling personal.

Turning Emotion Into Action With the Right Questions

A key portion of the webinar focused on practical questioning techniques advisors can use to move clients forward.

Rather than asking only technical or future-state questions, Jared emphasized reflective, emotion-focused prompts such as:

- How will you feel six months from now if nothing changes?

- What would it feel like to replace uncertainty with clarity?

- What’s the emotional cost of staying stuck?

These questions aren’t meant to pressure clients—they help owners articulate what they already feel but haven’t yet named. That clarity often becomes the catalyst for action.

Using Data to Support Emotional Engagement

Emotion may initiate action, but data sustains momentum.

This is where Capitaliz tools play a critical role in the advisor-client relationship.

Value Gap Assessment

The Value Gap Assessment provides a structured way to evaluate key areas of a business—operations, marketing, regulatory, legal, and more. But its real power lies in how advisors use it.

Instead of treating the results as a scorecard, advisors can connect gaps to emotional drivers:

- Why are you still working 70-hour weeks?

- What’s driving your urgency—or hesitation—to exit?

The assessment becomes a conversation starter, not just a diagnostic.

Business Insights Report

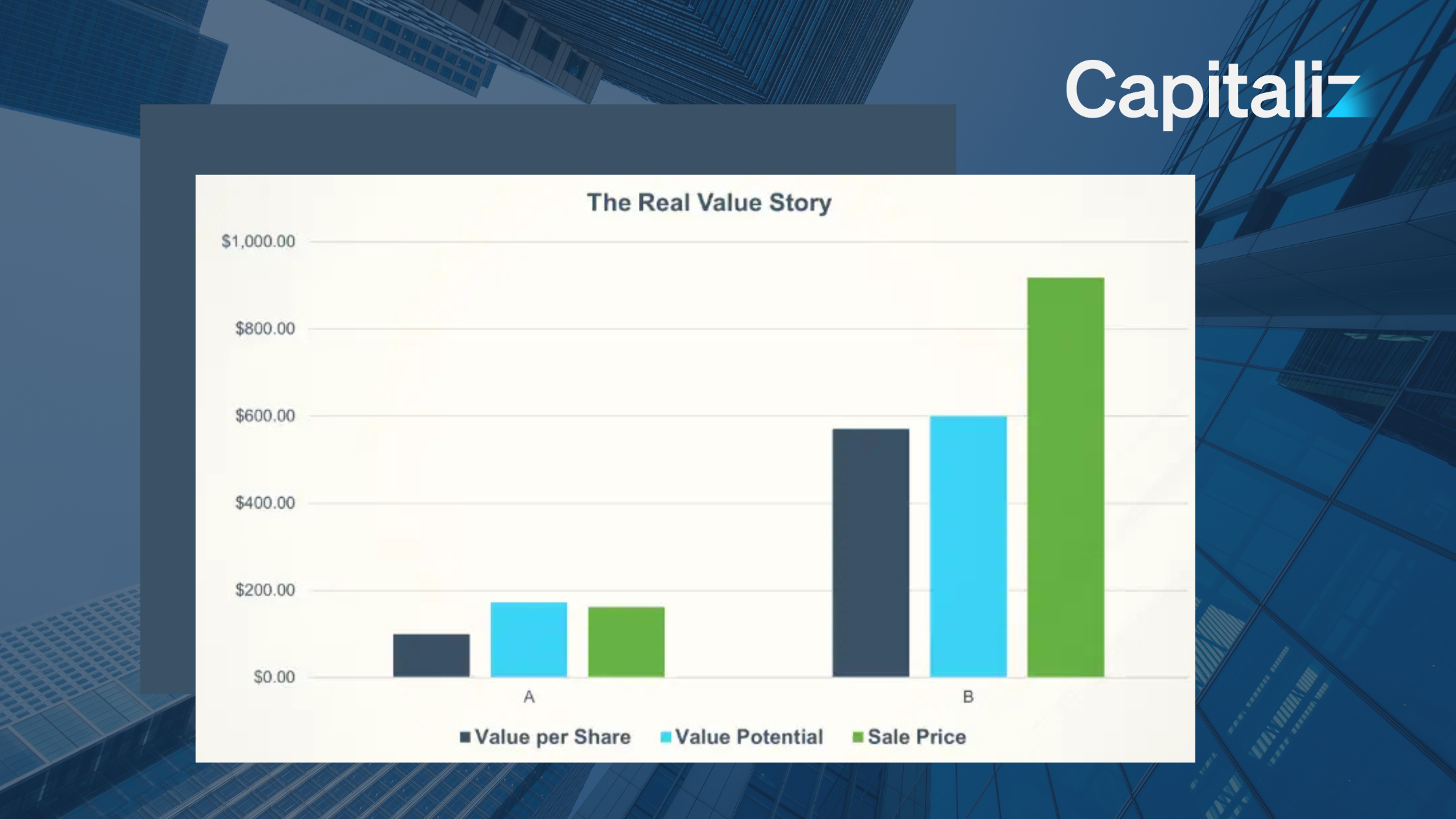

Once an owner commits to action, the Business Insights Report helps answer the logical follow-up question: What’s actually possible?

By modeling sustainable growth rates, capital needs, and value outcomes, advisors can ground emotional intent in realistic planning—bridging the gap between desire and execution.

Keeping Owners Engaged With Results

One of the biggest challenges in exit planning is maintaining momentum after the initial decision to act.

The webinar highlighted dynamic revaluation as a powerful engagement tool. Each completed action item is tied to a measurable change in business value, allowing owners to see tangible progress.

This creates a reinforcing cycle:

- Emotion drives the decision to act

- Logic and data shape the plan

- Results validate the effort and fuel continued engagement

When owners can see progress reflected in value—not just tasks completed—they’re far more likely to stay committed.

The Emotions–Logic–Results Cycle in Practice

Jared summarized this approach as a three-stage engagement model for advisors:

- Engage emotionally to prompt action

- Apply logic and data to build executable plans

- Demonstrate results to sustain momentum

This cycle aligns naturally with the Value Acceleration Methodology—discovery, prepare, and decide—ensuring that exit plans are not only technically sound but emotionally resonant.

Rethinking Year-End and Ongoing Reviews

The webinar concluded with a challenge to advisors: rethink how year-end and planning meetings are structured.

Instead of focusing solely on returns, metrics, or completed initiatives, consider asking:

- How do you feel about the decisions you made this year?

- What created clarity—and what created stress?

- What outcomes matter most emotionally in the year ahead?

These conversations deepen trust, strengthen engagement, and position advisors as true strategic partners.

Watch the Full Webinar: Emotion to Execution

To dive deeper into the concepts, questions, and tools discussed in this session, watch the full webinar recording:

👉 Emotion to Execution: Moving Owners Toward Meaningful Action

Final Thought for Advisors

Exit planning isn’t just a financial or strategic exercise—it’s an emotional journey.

Advisors who can meet owners where they are emotionally, guide them with logic, and reinforce progress with results will not only drive better exit outcomes—they’ll build stronger, longer-lasting advisory relationships.

At Capitaliz, we believe moving owners from emotion to execution is where real value acceleration begins.