In the world of wealth management, success hinges on more than just portfolio performance.

Business owners look to their advisors for strategic guidance rooted in data, insights, and tailored planning, not just numbers or assets under management (AUM). The Capitaliz platform empowers wealth managers and financial advisors to leverage powerful, data-backed insights that transform client relationships and elevate outcomes.

The Power of Data in Wealth Management

Today’s financial environment is complex, and understanding a client’s unique business and personal wealth picture is paramount.

Capitaliz helps advisors:

- Identify Gaps & Opportunities: Use comprehensive business insights to uncover hidden risks and growth areas.

- Align Goals & Strategies: Create integrated plans that marry business valuation, wealth transfer, and personal financial goals.

- Mitigate Risks: Spot operational, market, or ownership vulnerabilities early — including owner dependency, customer concentration, and operational deficiencies.

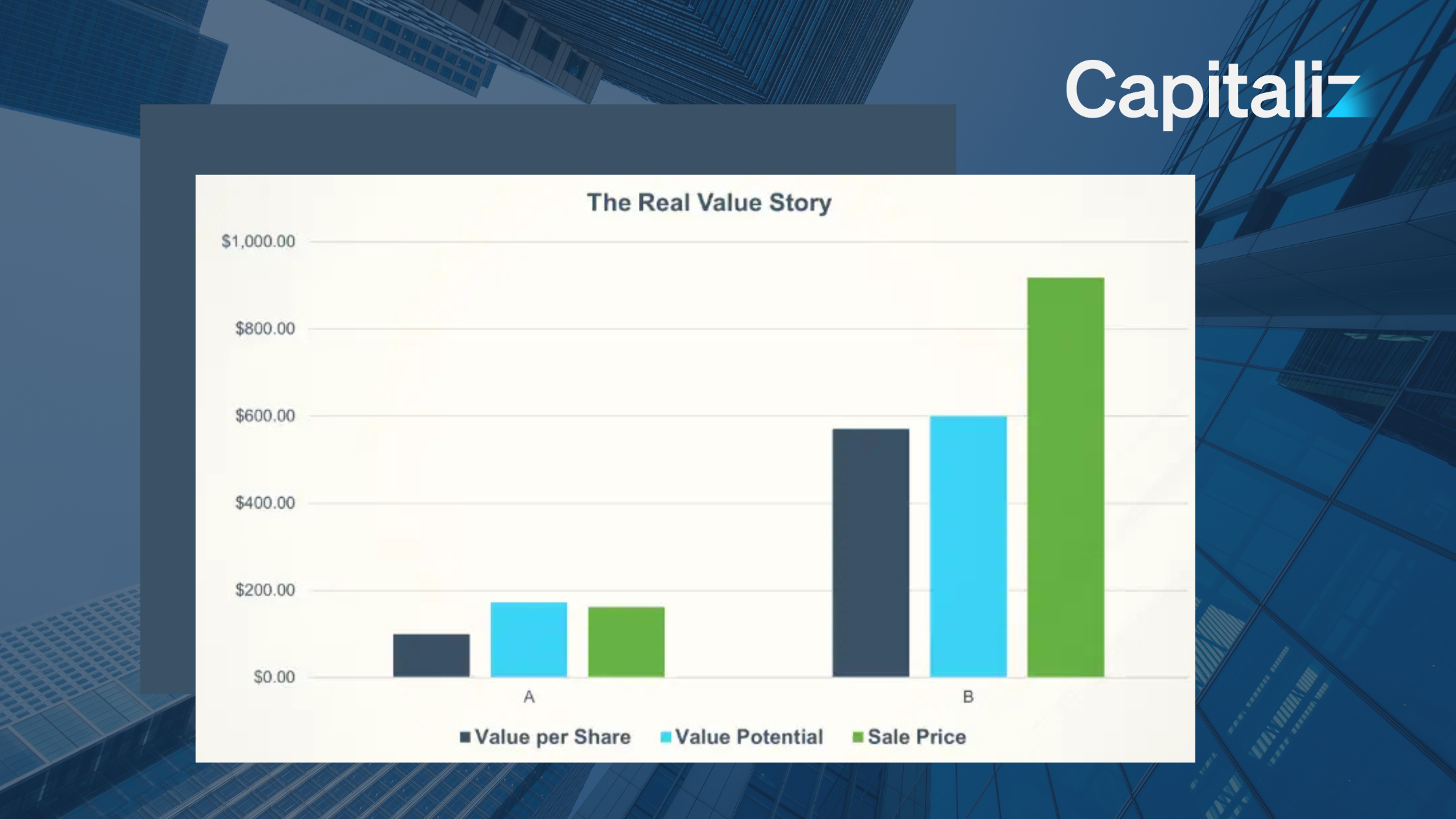

- Drive Long-Term Growth: Develop strategies that increase business valuation, assets under management, and overall wealth transfer success.

The Power of Exit Planning Tools for Wealth Managers and Financial Advisors

Staying ahead means leveraging every advantage, especially verified data. Exit planning tools like Capitaliz empower wealth managers and financial advisors to move beyond generic advice, providing clients with precise, tailored insights that underpin strategic decision-making based on the state of the business.

Capitaliz tools unlock a new level of clarity around business value, risks, and growth potential.

By integrating detailed analysis into your advisory process, you can:

- Identify Opportunities and Risks: Use comprehensive reports to highlight key gaps, vulnerabilities, and growth drivers within client businesses.

- Enhance Strategic Alignment: Create plans that marry business valuation with personal wealth transfer, estate planning, and succession strategies.

- Build Client Confidence: Back recommendations with validated data, increasing trust and fostering long-term relationships.

- Drive Measurable Results: Help clients increase business valuation, assets under management, and overall wealth transfer success through targeted initiatives.

The result? More confident clients, stronger relationships, and a reputation as a strategic, data-driven advisor.

The Capitaliz Platform — More Than a Tool for Wealth Managers and Financial Advisors

The Capitaliz platform transforms how wealth managers serve their clients and the entire owner experience. It’s not just a tool, but a strategic partner that integrates seamlessly into your advisory workflow, providing deep insights at every stage of the client journey.

Here’s why the platform is a game-changer:

- Comprehensive Business Insights Reports: Deliver detailed valuation analyses, SWOT assessments, and risk evaluations that help clients understand their business’s true value.

- Structured 21-Step Methodology: Guide clients through goal setting, fact gathering, strategic planning, and ongoing value management with clarity and discipline.

- Real-Time Data & Dynamic Revaluation: Continuously monitor progress and adjust strategies based on current data, ensuring consistent alignment with client goals.

- Facilitates Long-Term Engagements: From initial assessment to ongoing investment and estate planning, Capitaliz provides the insights needed to develop enduring client relationships.

Practitioners like Taylor Hodgesand David Ortiz have integrated Capitaliz into their practices to differentiate themselves, increase assets under management, and deliver impactful, data-backed advice.

As Taylor notes, “The platform helps us develop long-term, impactful relationships with clients, offering insights that truly move the needle.”

Real-World Impact — The Taylor Hodges Success Story

Taylor Hodges, Founder of Southern Capital, demonstrates how data-driven insights can revolutionize a wealth advisory practice.

By utilizing Capitaliz’s Business Insights Report, Taylor gained a detailed understanding of his clients’ business value, risks, and opportunities.

This enabled him to craft tailored strategies that:

- Differentiate his firm in a competitive Florida market.

- Facilitate strategic growth through targeted operational improvements.

- Strengthen client relationships by providing clarity and confidence in their wealth and business decisions.

- Increase Assets Under Management (AUM): Almost all initial clients transitioned into long-term planning engagements, boosting revenue and client loyalty.

Check out the full case study here.

Key Benefits for Wealth Managers (Practical Applications)

| Data-Backed Insights | Enhanced Client Outcomes | Market Differentiation | Sustainable Growth |

| Deep analysis of business and personal wealth | Increased client confidence and engagement | Stand out through strategic, data-driven advice | Long-term AUM growth and revenue expansion |

| Identification of risks and opportunities | Better decision-making for clients | Development of tailored, impactful strategies | Recurring revenue from ongoing advisory services |

How to Incorporate Capitaliz into Your Wealth Management Practic

- Initial Stage (Capitaiz Steps 1-3): Use the platform to gather facts, set goals, and produce insights reports that form the foundation of your strategic advice.

- Strategic Planning (Capitaliz Steps 8-9): Leverage detailed analysis to craft customized growth, risk mitigation, and wealth transfer strategies.

- Ongoing Management (Capitaliz Steps 19-21): Use continuous data insights for investment reviews, estate planning, and asset protection.

Embedding data-driven insights into your advisory process empowers you to deliver measurable, impactful outcomes, strengthening client trust and fostering long-term loyalty.

Partner with Capitaliz Today

Leverage data insights to transform your wealth management practice.

Schedule a demo: capitaliz.com/get-started